Revolutionizing Car Insurance with AI Workflow Automation in Chatbots

The automotive insurance industry is witnessing a significant transformation through the integration of AI-driven technologies, particularly with Agentic AI enhancing the capabilities of chatbots. These advancements streamline various aspects of car insurance from claims processing to policy renewal. This article delves into the impact of AI Workflow Automation WordPress plugin on car insurance chatbots, detailing specific workflows that optimize efficiency and customer experience.

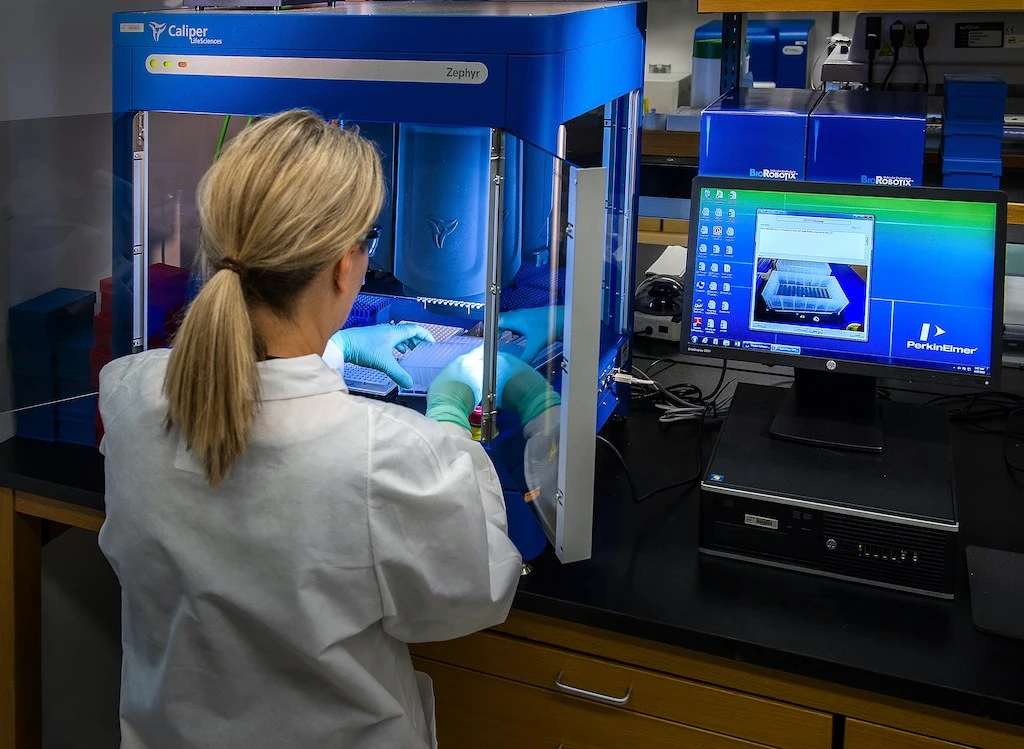

Workflow 1: Automated Claims First Notice of Loss (FNOL)

Streamlining the initial claims reporting process is crucial for reducing customer frustration and accelerating car insurance claims processing. The AI Workflow Automation plugin facilitates this through a robust workflow:

-

- Initiation with a Webhook Trigger that receives data directly from the chatbot interface on the website.

-

- Integration with an AI Model Node (using Claude 3.5 Opus) to analyze initial claim descriptions efficiently.

-

- Utilization of an Extract Information Node to extract structured data such as accident date/time/location, involved vehicles, policy information, and injury details.

-

- Routing based on claim severity with a Condition Node.

-

- For high-severity claims, an alert sent via a Send Email Node to notify claims adjusters.

-

- For standard claims, an API Call Node creates a claim in the core insurance system.

-

- Lastly, a Chat Node provides claim confirmation and guidance on next steps to the customer.

This workflow not only improves the speed and accuracy of the claims processing but also aligns with the growing trend of AI adoption in the insurance sector, as highlighted by recent statistics showing a 60% YoY increase in AI usage for claims processing in 2023.

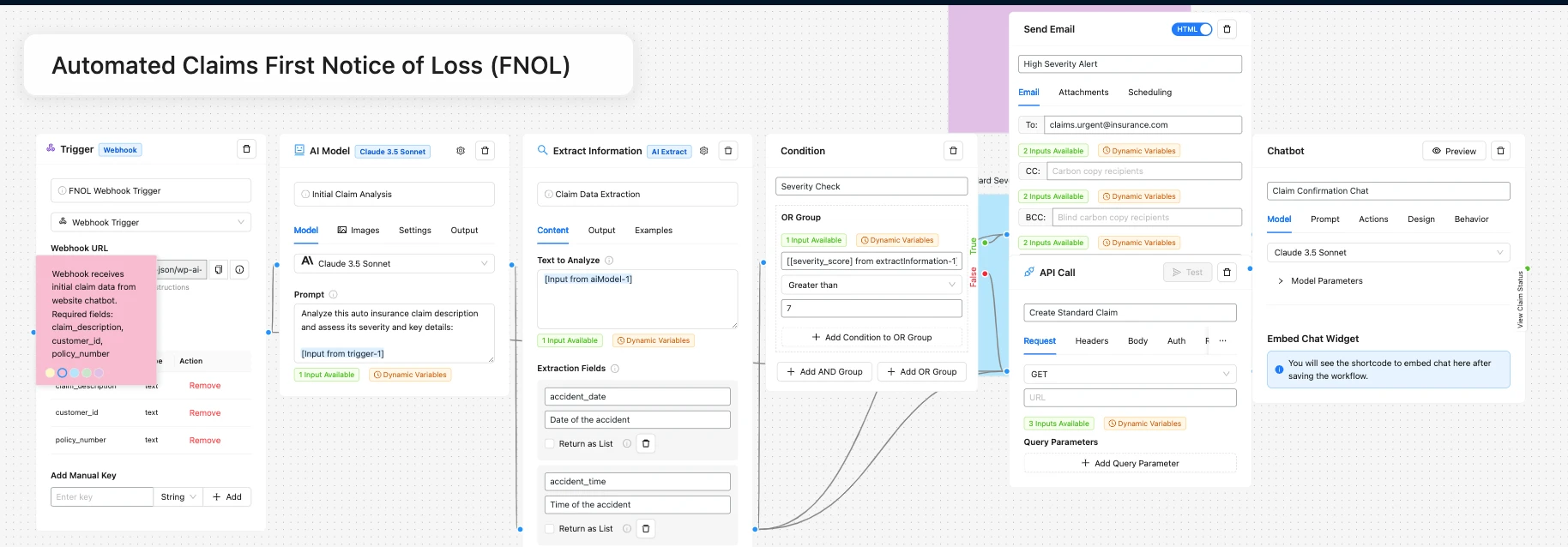

Workflow 2: Vehicle Coverage Advisor

Understanding the appropriate coverage levels for their specific vehicle and driving habits empowers customers, enhancing satisfaction and potentially increasing car insurance premium revenue. Here’s how the AI Workflow Automation plugin facilitates this with an automated advisor workflow:

-

- Begin with a Manual Trigger from the coverage advisor chatbot.

-

- Employ an AI Model Node (GPT-4) to gather and analyze customer input on vehicle specifications, driving habits, budget, and risk tolerance.

-

- Use a Research Node to compile vehicle-specific data including safety ratings, replacement cost, and theft statistics.

-

- An API Call Node retrieves current coverage options and pricing.

-

- A specialized AI Model Node generates personalized coverage recommendations.

-

- Recommendations are shared through a Chat Node with visual comparisons for clarity.

-

- Include a Human Input Node for agent review should the customer desire human interaction.

-

- Finally, a Post Node saves the recommendation for future reference.

This workflow enriches customer engagement by providing tailored advice, aligning with trends like personalized policy recommendations as evidenced by industry leaders leveraging AI [ source: HDFC Ergo].

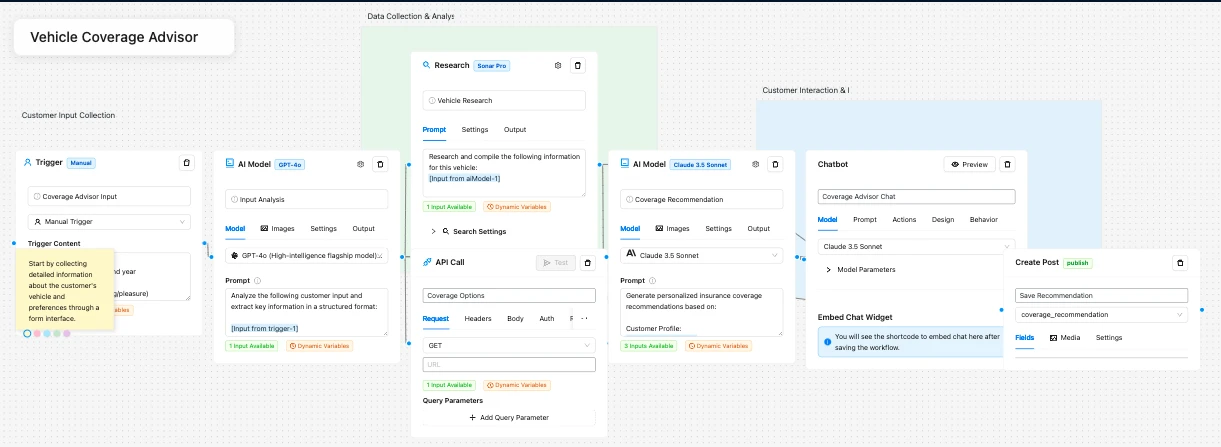

Workflow 3: Accident Scene Documentation Assistant

Proper documentation of accident scenes in real-time is essential for efficient car insurance claims processing. The AI Workflow Automation plugin offers an assistant workflow to guide drivers:

-

- Start with a Webhook Trigger from the mobile chatbot interface.

-

- Utilize a vision-capable AI Model Node (GPT-4 Vision or Gemini) to analyze accident scene photos.

-

- Deploy an Extract Information Node to identify visible damage, license plates, road conditions, and safety concerns.

-

- A Condition Node checks for emergencies or safety issues.

-

- In emergencies, send alerts through a Send Email Node to emergency services.

-

- A Chat Node guides the user to collect additional information like other driver’s details, witness statements, and police report details.

-

- Store all documentation using the Save to Database node.

-

- Finally, an API Call Node initiates the claims process automatically.

This streamlined workflow directly contributes to operational efficiency and enhanced customer experience by facilitating comprehensive and immediate accident documentation, which is in line with the 24/7 support trend addressed by AI chatbots [ source: Botpress].

Workflow 4: Policy Renewal Optimization

Engaging customers proactively before their car insurance policy renews can reduce churn and increase coverage adoption. The AI Workflow Automation plugin aids this with an optimized renewal workflow:

-

- Trigger 30 days before renewal using a WordPress Core Trigger.

-

- Retrieve customer data via an API Call Node, including current coverage, claims history, payment history, and vehicle information.

-

- Use a Research Node to gather market rate changes, new coverage options, and relevant customer life events.

-

- Feed this data into an AI Model Node (Claude 3.5 Sonnet) to generate personalized renewal recommendations.

-

- A Condition Node segments customers by renewal risk.

-

- For high-risk customers, initiate a Human Input Node for agent review.

-

- Engage customers through a Chat Node with personalized renewal conversations.

-

- Process renewal changes directly with an API Call Node.

This workflow exemplifies the use of real-time analytics to predict policy lapse risks and offer tailored benefits, aligning with the future trends pointed out by industry analyses.

Workflow 5: Smart Quote Generator

Streamlining the quoting process ensures car insurance offers are accurate, competitive, and meet customer needs. Here’s how the AI Workflow Automation plugin streamlines quote generation:

-

- Start with a Gravity Forms Trigger to capture initial quote request data.

-

- An AI Model Node (GPT-4) analyzes customer needs and identifies missing information.

-

- Deploy a Chat Node to gather additional details conversationally.

-

- Connect to a Web Scraper/Crawler Node to verify vehicle information.

-

- An API Call Node retrieves driver record information, insurance scores, and property address verification.

-

- A Condition Node determines eligibility for special programs or discounts.

-

- Feed compiled data to an AI Model Node for generating various coverage options.

-

- Present these via the Chat Node with options for interactive quote customization.

-

- Utilize a Post Node to save quote information for future reference.

This workflow reflects the industry shift towards personalized advice and competitive offerings, particularly relevant as 90% of insurers plan to increase AI investments by 2024.

Conclusion

The integration of Agentic AI into car insurance chatbots through the AI Workflow Automation WordPress plugin enhances operational efficiency, customer satisfaction, and drives innovation across various facets of the insurance lifecycle. From claims processing to policy renewals and quote generation, these workflows demonstrate the transformative potential of AI in the car insurance industry.

Looking ahead, trends such as generative AI, blockchain contracts, and cognitive assistants are poised to further revolutionize car insurance, with companies like Lemonade and HDFC Ergo leading the charge in leveraging these technologies for a competitive edge.