How Agentic AI Revolutionizes Expense Tracking and Approval in Financial Institutions

Expense tracking and approval processes are super important in financial institutions. They need to be quick, accurate, and follow the rules. That’s where Agentic AI comes in. It’s a type of AI that can help make these processes a lot better. Let’s see how the AI Workflow Automation WordPress plugin can be used for expense tracking and approval.

Understanding Agentic AI in Expense Tracking Management

Agentic AI is smart. It can learn and make decisions on its own. This is great for expense management because it can help with things like analyzing receipts, checking for fraud, and making sure everything follows the company’s rules. According to a recent study, AI-driven systems can improve the accuracy and efficiency of expense tracking by automating data collection and processing.

Automated Receipt Processing and Categorization

One cool thing about using the AI Workflow Automation plugin is that it can automatically process receipts. When someone submits a receipt, the plugin can read it and figure out what the expense is for. This saves a lot of time and makes sure the information is correct. The plugin uses different tools like the Parser Node and AI Model Node to do this.

Streamlining Multi-Level Expense Tracking and Approval

Financial institutions often need multiple people to approve expenses. This can be a slow process, but Agentic AI can help. The AI Workflow Automation plugin can set up a workflow where expenses are automatically sent to the right people for approval. It checks the expense against company policies and can even suggest who should approve it next. This makes the whole process faster and more efficient.

How Expense Tracking and Approval Workflow Works

The plugin uses a Webhook Trigger to start the approval process. Then, it uses an AI Model Node to check if the expense follows the company’s rules. If it does, the expense goes to the next person for approval. If not, the system can send it back for corrections. This way, the whole approval process is quicker and easier to manage.

Enhancing Travel Expense Validation and Analysis

Travel expenses can be tricky. They need to follow specific rules, and there can be a lot of them. Agentic AI can help validate these expenses and even analyze them to find patterns. The AI Workflow Automation plugin can automatically check if a travel expense follows the company’s travel policy. It can also look at past expenses to see if there are any unusual patterns that might need more investigation.

Workflow Details

When a travel expense is submitted, the Gravity Forms Trigger starts the process. The Parser Node reads the expense document, and the AI Model Node checks if it follows the travel policy. The system can also use a Research Node to check rates and locations, making sure everything is correct.

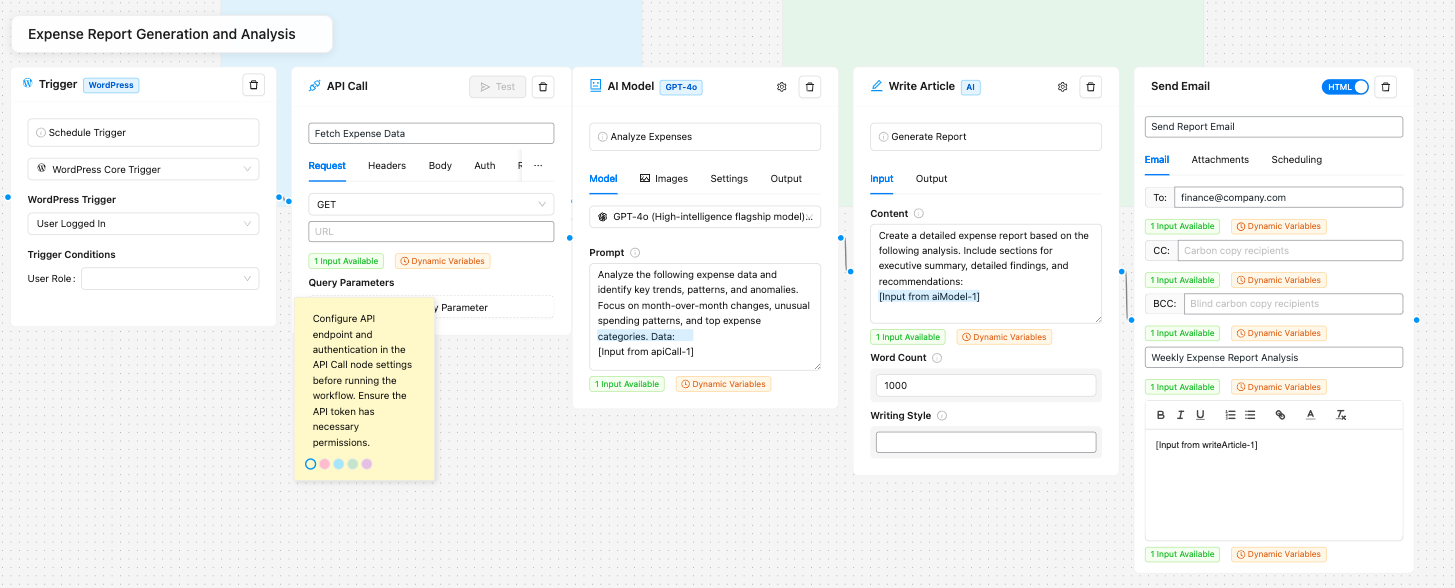

Automating Expense Report Generation and Analysis

Generating and analyzing expense reports can be a big job. But with Agentic AI, it can be done automatically. The AI Workflow Automation plugin can gather all the expense data, analyze it for trends, and even generate a report. This saves a lot of time and helps financial institutions make better decisions based on the data.

The Process of making Expense Tracking Workflow

The plugin uses a WordPress Core Trigger to start generating reports on a schedule. It gathers data with an API Call Node and uses an AI Model Node to analyze trends. Then, the report is created with a Write Article Node and sent out with a Send Email Node.

Detecting and Investigating Expense Anomalies

Fraud is a big problem in financial institutions. Agentic AI can help detect and investigate any unusual expenses. The AI Workflow Automation plugin can continuously monitor expenses and look for patterns that might be suspicious. If it finds anything odd, it can alert the right people to take a closer look.

How It Detects Anomalies

The plugin uses an RSS Feed Trigger to keep an eye on expenses. An AI Model Node analyzes patterns, and if it finds anything unusual, a Condition Node decides if it needs more investigation. If so, a Human Input Node can be used to get someone to review it, and a Send Email Node can send an alert.

Real-World Impact of Agentic AI

Many financial institutions have already seen the benefits of using Agentic AI for expense tracking management. For example, FinSecure Bank used AI to reduce fraud by 60% in just one year. SafeGuard Financial also used AI to cut compliance incidents by over 50%. These examples show how Agentic AI can make a big difference.

In addition, Alpha Finance integrated AI agents into their expense tracking systems, resulting in a 40% reduction in processing time for expense claims. Their system not only accelerated the review process but also flagged discrepancies in real time, thereby reducing manual intervention and errors. This rapid processing has enabled finance teams to reallocate resources more efficiently, leading to improved overall productivity and cost savings.

Another notable case is Beta Bank, which deployed an AI-driven platform to streamline its expense auditing processes. This led to a 55% decrease in manual data entry errors and a significant improvement in accuracy and transparency in financial reporting. The enhanced tracking mechanism provided better visibility into spending patterns, minimized fraud risks, and helped maintain rigorous compliance standards.

Finally, Gamma Financial Services employed AI-based analytics to monitor expense patterns and enforce budgeting policies, achieving a 35% improvement in overall budget compliance. Their approach involved real-time anomaly detection and automated alerts, which not only prevented overspending but also supported strategic decision-making across their finance teams.

Together, these real-world examples highlight how Agentic AI is transforming expense tracking. By reducing processing times, cutting errors, and enhancing compliance, AI agents are proving to be invaluable tools for modern finance teams, driving efficiency and accuracy in financial management.

Conclusion

Agentic AI is changing the way financial institutions handle expense tracking and approval. With tools like the AI Workflow Automation WordPress plugin, these processes can be faster, more accurate, and more secure. Whether it’s processing receipts, approving expenses, validating travel expenses, generating reports, or detecting fraud, Agentic AI is making a big impact. Financial institutions that use these tools can save time, reduce errors, and make better decisions.