Boosting Agentic AI Stocks Performance with AI Workflow Automation

The integration of Artificial Intelligence (AI) into the financial sector has redefined how investors approach the stock market, especially within sectors like Agentic AI Stocks. The use of AI workflow automation through plugins like the AI Workflow Automation for WordPress has emerged as a critical tool for companies seeking to gain an edge in this dynamic market. This article delves into how these advanced AI capabilities are implemented across different workflows to optimize stock market analysis and investment strategies.

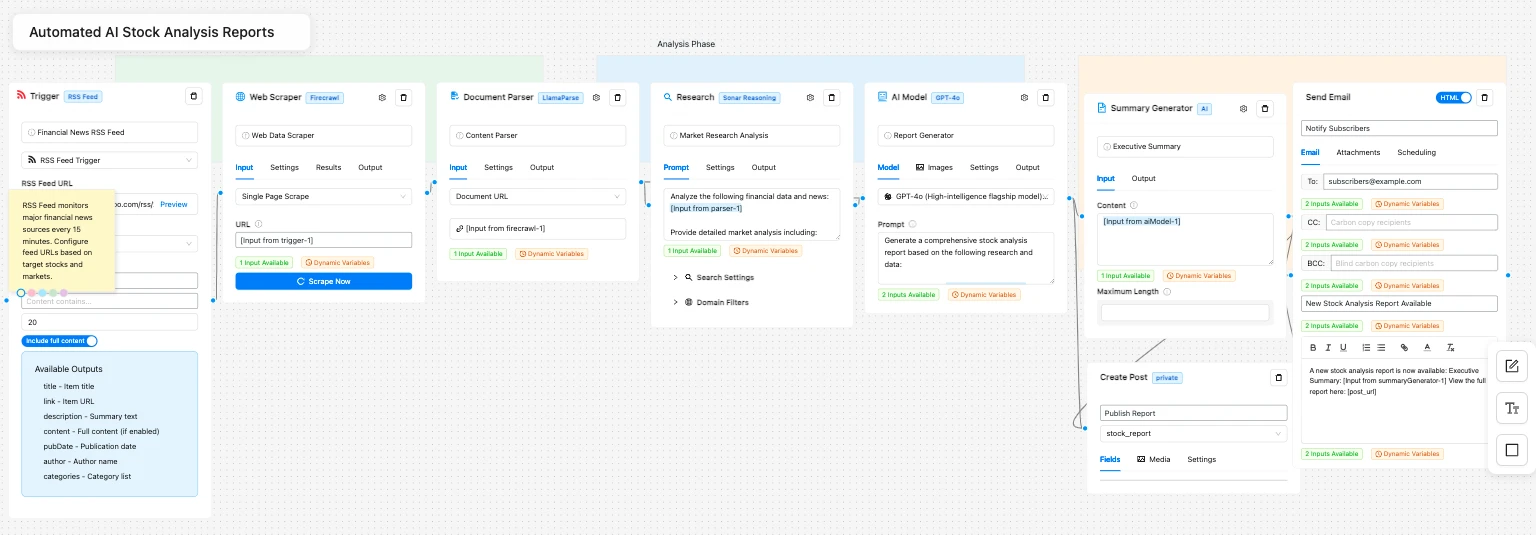

Automated AI Stock Analysis Reports

One of the pivotal uses of AI within Agentic AI Stocks companies is the creation of Automated AI Stock Analysis Reports. This process involves aggregating data from multiple sources to provide comprehensive insights which financial analysts can use to inform their strategies. The workflow begins with an RSS Feed Trigger for monitoring financial news feeds, followed by several steps including a Web Scraper/Crawler Node to extract data, a Parser Node to process the information, and ultimately, leveraging AI Model Node using GPT-4 to synthesize actionable insights. The final steps involve generating summaries and full reports, posting them securely, and notifying subscribers via email.

Impact on Stock Performance

The use of AI to automate stock analysis can significantly enhance the decision-making process for investors by providing timely, accurate, and in-depth analyses. According to Goldman Sachs, the adoption of AI in investment strategies could potentially increase the S&P 500 EPS growth to a 5.4% CAGR over the next 20 years, thereby potentially boosting the value of Agentic AI Stocks.

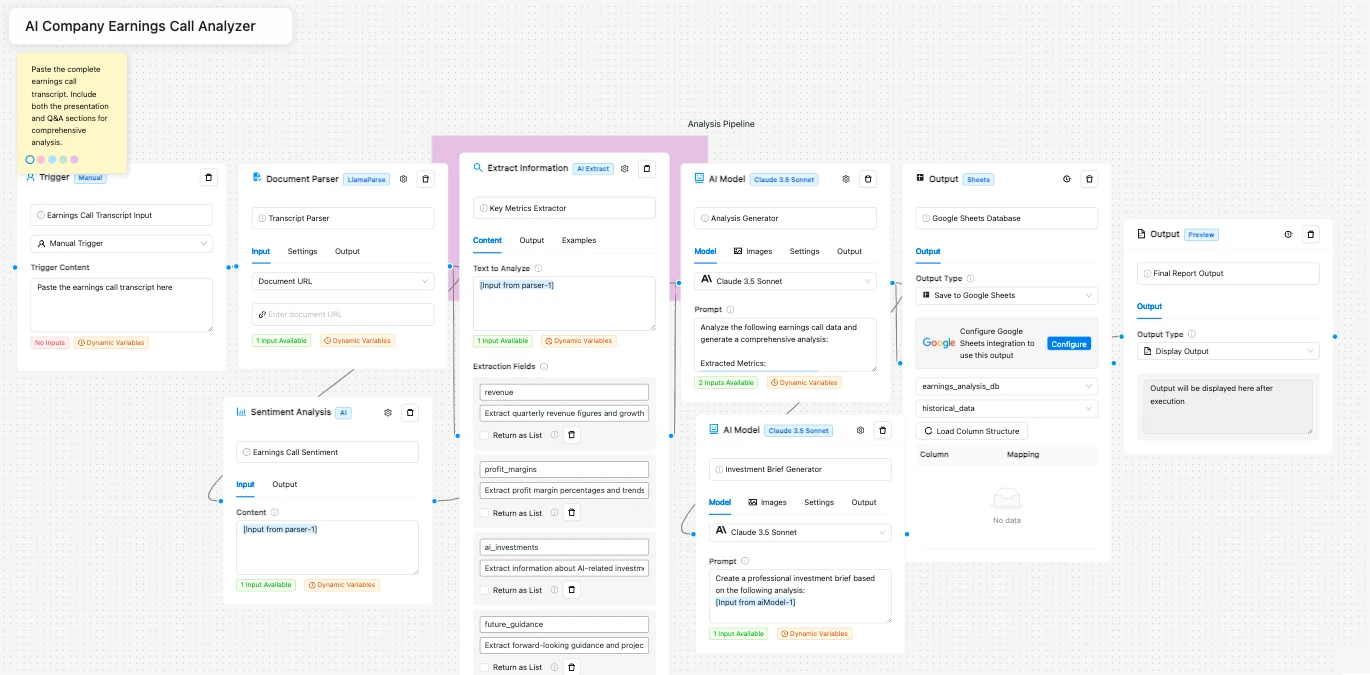

AI Company Earnings Call Analyzer

Another critical application in Agentic AI Stocks companies is the automated analysis of earnings calls, a process facilitated by the Manual Trigger that accepts transcripts. The workflow proceeds through parsing, extracting key information, and sentiment analysis. Utilizing an AI model like Claude 3.5 Opus, it compares current data with historical performance, categorizes the outcomes, and maintains a database in Google Sheets. The resulting investor brief is formatted to include actionable trading suggestions, offering profound insights into the company’s performance and future directions.

Enhancing Transparency and Decision-Making

By employing such detailed analysis, companies dealing in Agentic AI Stocks can offer more transparent insights to their investors. Vanguard suggests this level of transparency could lead to better-informed investment decisions, potentially reducing volatility for Agentic AI Stocks.

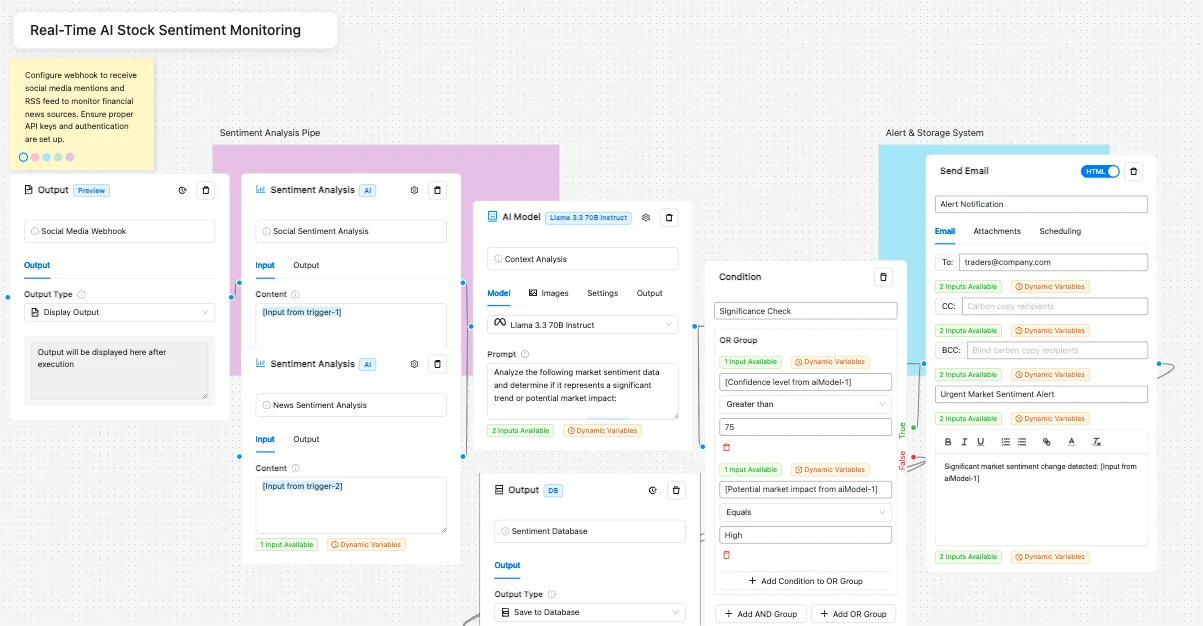

Real-Time AI Stock Sentiment Monitoring

The volatile nature of the stock market necessitates real-time monitoring of market sentiment, a need well-served by Real-Time AI Stock Sentiment Monitoring workflows. This involves using a Webhook Trigger to react instantly to social media and news mentions, followed by sentiment analysis, context filtering with AI like Llama 3.3 70B, and immediate alerts for significant changes. The final steps involve tracking trends over time and updating a real-time dashboard, providing traders with tools to spot trends before they fully impact stock prices.

Market Efficiency and Risk Management

This real-time approach not only aids in market efficiency but also helps in risk management. As noted by the IMF, AI can improve market efficiency yet increase market volatility, a factor that affects Agentic AI Stocks directly.

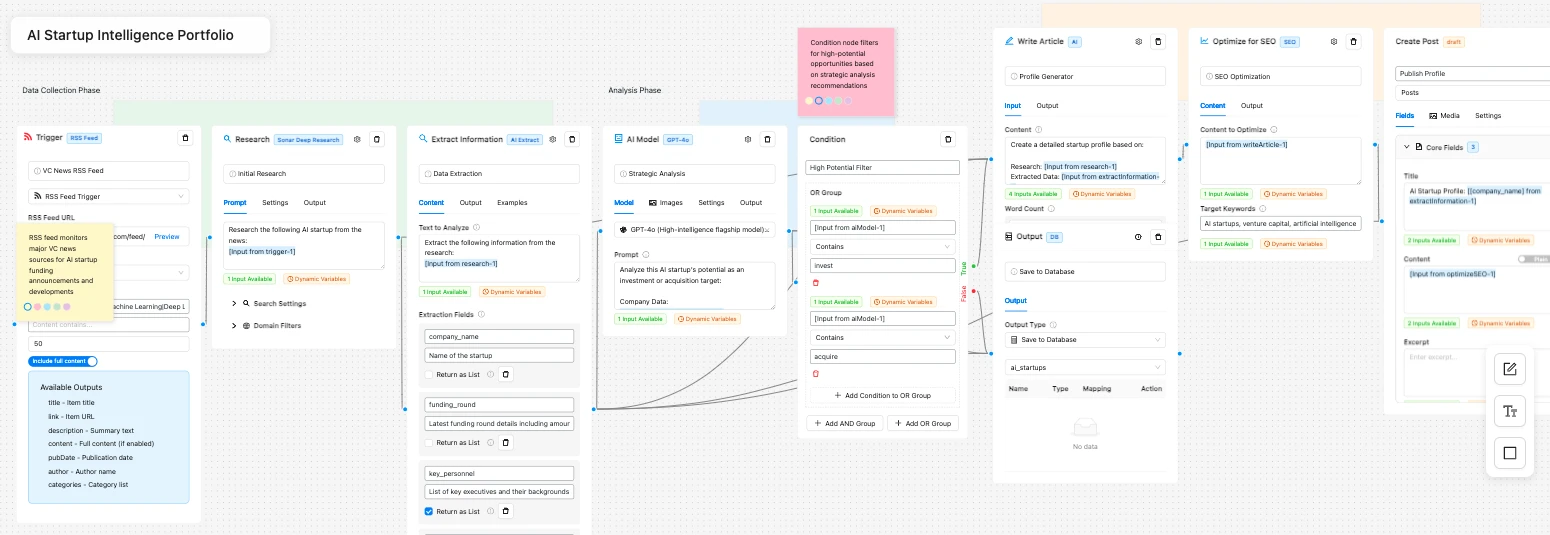

AI Startup Intelligence Portfolio

Monitoring potential disruptors in the AI sector can provide Agentic AI Stocks companies with insights on future trends or acquisition targets. This is achieved through workflows starting with an RSS Feed Trigger to monitor venture capital news, followed by extensive research and AI analysis using GPT-4. The workflow includes structuring data about funding rounds and key personnel and publishing detailed startup profiles weekly.

Strategic Investment Opportunities

Such intelligence can significantly influence the strategic decision-making of companies involved in Agentic AI Stocks, offering them opportunities to invest in or acquire burgeoning startups that align with their business strategy.

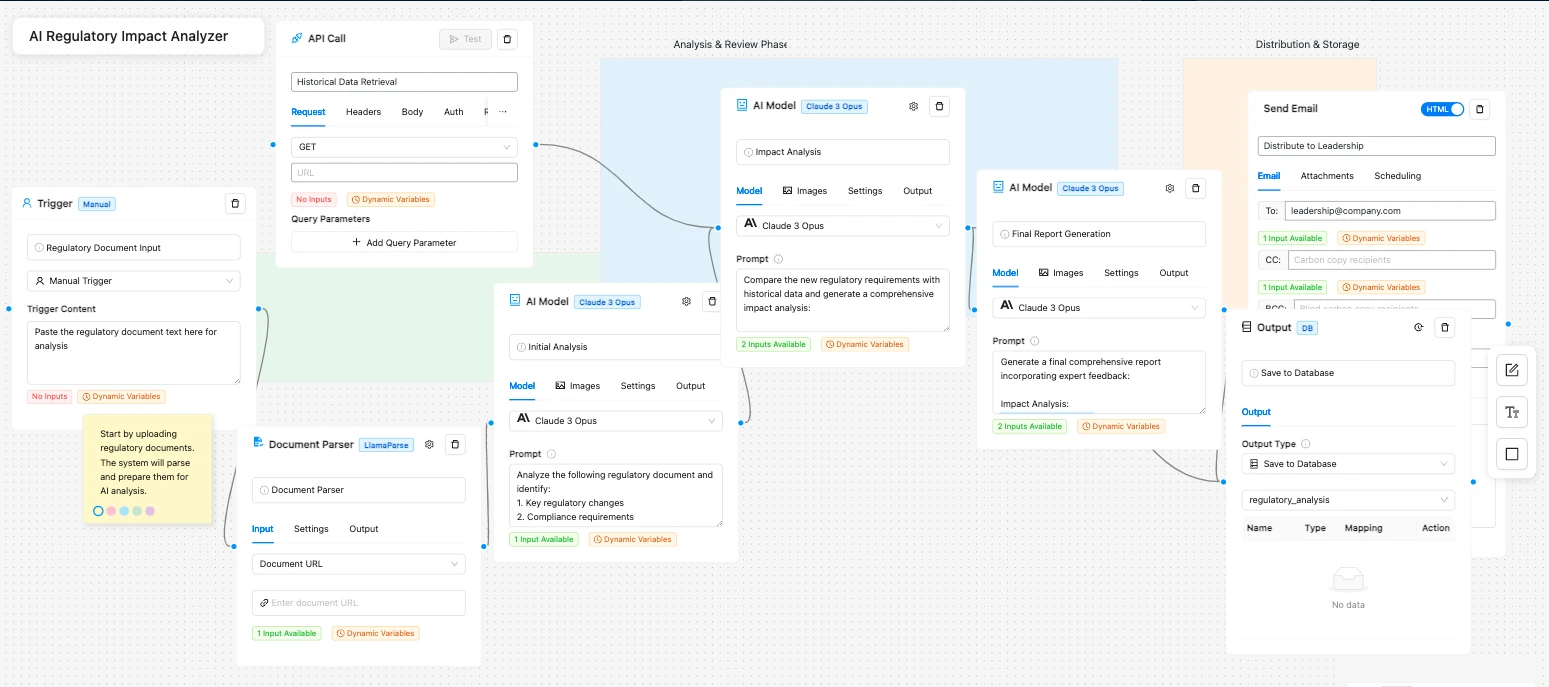

AI Regulatory Impact Analyzer

Understanding the impact of emerging regulations is crucial for Agentic AI Stocks to navigate potential legal and financial challenges. This process is automated through workflows that include regulatory text analysis by AI models like Claude 3.5 Opus, historical data analysis via API Calls, and expert human input to validate the AI’s analysis. The complete impact assessment is then distributed to relevant teams.

Risk Mitigation and Compliance

By forecasting regulatory impacts, companies can better prepare for changes, as highlighted by ESMA, mitigating risks and ensuring compliance, which is particularly valuable for Agentic AI Stocks.

AI Stock Technical Analysis with Natural Language Insights

Combining traditional technical analysis with AI-driven natural language interpretation offers a more accessible and comprehensive understanding of market dynamics for Agentic AI Stocks. The workflow starts with daily triggers after market close, followed by retrieving technical indicators and interpreting patterns with AI like Gemini. The analysis is categorized, visualized with relevant images, and optimized for SEO before being posted and integrated into chat platforms.

Accessibility and Engagement

This approach not only improves the accessibility of complex market data but also engages investors more effectively, crucial for the success and growth of Agentic AI Stocks companies.

Conclusion

The integration of AI workflow automation into the operations of Agentic AI Stocks companies is transforming the landscape of stock market analysis and investment strategy formulation. These sophisticated tools provide a competitive edge through improved analysis, real-time monitoring, regulatory preparedness, and enhanced investor communication. As AI continues to evolve, the potential for these companies to leverage such technologies in more innovative ways remains boundless, promising a future of growth, efficiency, and advanced market intelligence.