The Role of Agentic AI in Streamlining Client Onboarding for Financial Institutions

In the fast-paced world of finance, every second counts. Financial institutions are constantly seeking ways to improve their services, especially when it comes to client onboarding. This is where Agentic AI, a smart and adaptable type of artificial intelligence, comes into play. Agentic AI helps streamline processes, making them faster and more efficient. Imagine being able to onboard new clients smoothly and quickly, enhancing their overall experience. That’s what Agentic AI can do for your financial institution.

What is Agentic AI?

Agentic AI is a type of AI that can perform tasks independently, learning and adapting as it goes. It’s like having a smart assistant that can handle various aspects of client onboarding without constant supervision. By using Agentic AI, financial institutions can automate many steps, from document verification to risk assessment.

Benefits of Agentic AI in Client Onboarding

1. Automated Document Verification

One of the first steps in client onboarding is verifying documents. This can be a slow and Manual process. But with Agentic AI, this task becomes much easier. The AI Workflow Automation plugin can be used to automatically verify IDs, passports, and utility bills. This not only speeds up the process but also reduces the risk of errors. According to a recent study from fintech.global, AI-powered solutions can scan and verify documents in just seconds, extracting necessary information with high accuracy.

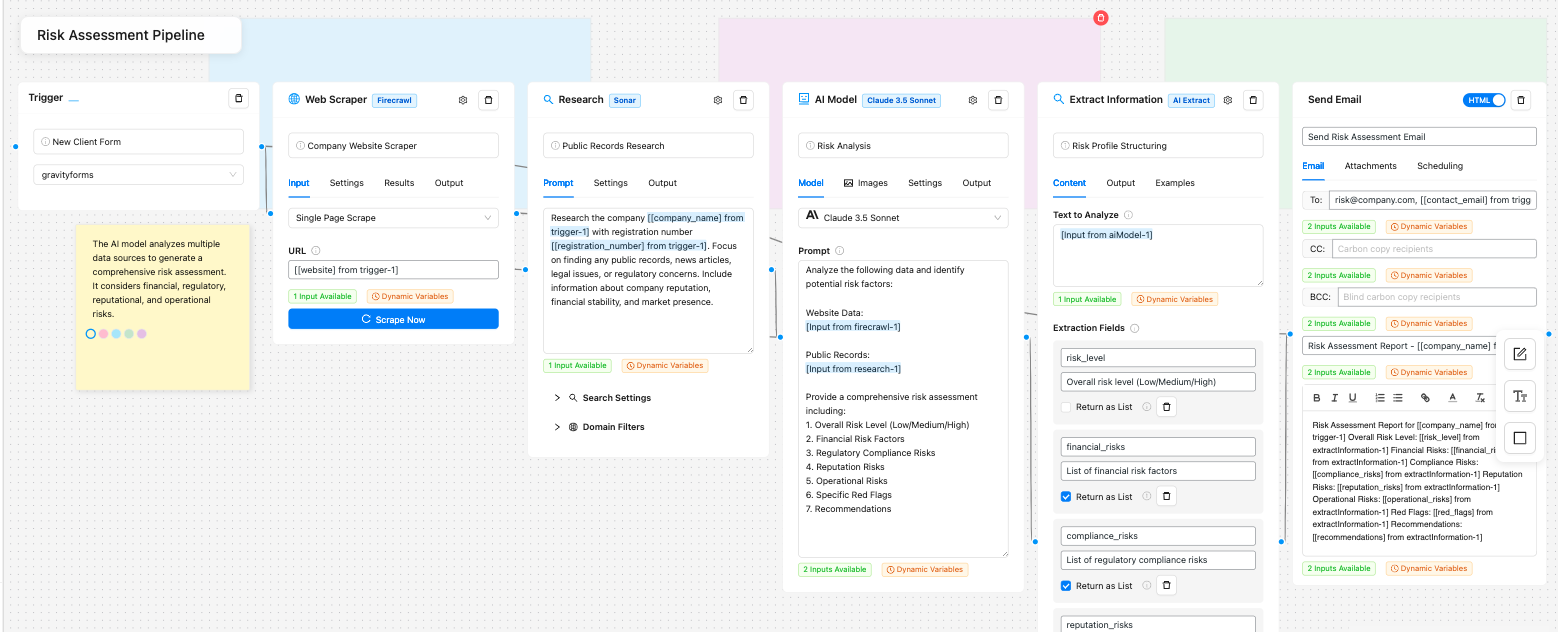

2. Risk Assessment Pipeline

Assessing risk is crucial for financial institutions. Agentic AI can help automate the initial risk assessment for new clients. By using tools like the Web Scraper Node, the AI can gather public records and analyze them for risk factors. This not only speeds up the process but also provides a structured risk profile for each client. According to a report from itemize.com, hyper-automation can reduce processing times by up to 80% and significantly cut operational costs.

3. Personalized Client Communication

Communication is key during client onboarding. Agentic AI can help create personalized welcome messages and provide immediate support through chatbots. The WordPress Core Trigger can be used to start this process automatically when a new client registers. This not only ensures consistent and personalized communication but also improves client engagement and loyalty. A study by codalien.com highlights how AI can predict cash flow trends for businesses, offering early warnings for potential issues.

4. Compliance Documentation Generator

Compliance is a big deal in the financial sector. Agentic AI can help by automatically generating required compliance documents. This can be done using the Webhook Trigger combined with AI models like GPT-4. This not only saves time but also reduces the risk of non-compliance. According to a report by Jumio, AI can automate KYC processes, making them more efficient and accurate.

5. Investment Profile Analysis

Understanding a client’s investment profile is crucial for financial advisors. Agentic AI can help by automatically analyzing investment questionnaires and generating tailored strategies. This can be done using tools like the Gravity Forms Trigger. This not only saves time but also helps in providing personalized advice to clients. According to a study from hyperverge.co, AI can analyze vast datasets in real-time, offering insights for strategic decision-making.

Real-Life Success Stories

Several financial institutions have already seen the benefits of using Agentic AI in their client onboarding processes.

Federal Bank

The Federal Bank has utilized AI to manage banking operations seamlessly. According to a report from codalien.com, they achieved 98% accuracy in answering customer queries and aim to reduce customer care costs by 50% through AI automation by 2025.

JPMorgan Chase

JPMorgan Chase uses AI to accelerate processing and improve customer satisfaction. They’ve seen a 15 to 20 percent reduction in the rejection of account validation, as reported by codalien.com. This not only speeds up the onboarding process but also enhances client trust and satisfaction.

Citi Bank

Citibank employs AI to validate payments and provide timely insights based on client needs. A study by codalien.com highlights how this approach has helped them improve their client onboarding process, making it more personalized and efficient.

The Future of Agentic AI in Finance

The future looks bright for Agentic AI in the financial sector. As technology continues to evolve, more financial institutions will likely adopt this smart solution to enhance their client onboarding processes. The benefits are clear: faster onboarding, reduced errors, and improved client satisfaction. By leveraging Agentic AI, financial institutions can stay ahead of the competition and provide top-notch services to their clients.

In conclusion, Agentic AI is revolutionizing client onboarding in financial institutions. By automating tasks like document verification, risk assessment, and personalized communication, it’s making the process smoother and more efficient. Real-life success stories from banks like Federal Bank, JPMorgan Chase, and Citi Bank show that this technology is not just the future; it’s the present. So, if you’re in the financial sector, it’s time to embrace Agentic AI and see the difference it can make in your client onboarding process.