How Agentic AI Transforms Automated Financial Reporting in Financial Institutions

Have you ever wondered how banks and other financial institutions manage to keep their books in order with such accuracy and speed? It’s all thanks to a game-changer called Agentic AI. This technology is crucial for handling the complex world of Automated Financial Reporting (AFR). Let’s dive into how Agentic AI is revolutionizing the way financial institutions handle their reporting tasks.

What Makes Agentic AI Special?

Agentic AI isn’t just any AI; it’s designed to act on its own and make decisions to achieve specific goals. This means it can automate entire workflows, from gathering data to generating detailed reports. In financial institutions, the AI Workflow Automation Plugin translates to faster, more accurate, and compliant financial reports.

Increased Efficiency

Financial processes can now be completed 85 times faster thanks to automation. According to a recent study, Agentic AI takes routine tasks like data entry and reconciliation off the hands of employees. This not only speeds up the process but also reduces the chances of human errors.

Enhanced Accuracy and Compliance

With Agentic AI, financial institutions can reduce reporting errors by as much as 90%. According to research, AI ensures compliance by constantly monitoring transactions against standards like GAAP and IFRS. Any potential violation is flagged instantly, keeping the institutions in line with regulations.

Real-World Applications of Agentic AI in Financial Reporting

Let’s look at some specific ways financial institutions are using Agentic AI to streamline their operations.

Automated Daily Transaction Reports

Every day, banks need to keep tabs on their transactions. Agentic AI can automatically generate these reports, ensuring that stakeholders receive up-to-date information without delay by email.

Regulatory Compliance Reports

Financial institutions are under constant scrutiny to comply with regulations. Agentic AI helps automate these reports, ensuring they are prepared and sent on time. According to research, this automation improves compliance efficiency.

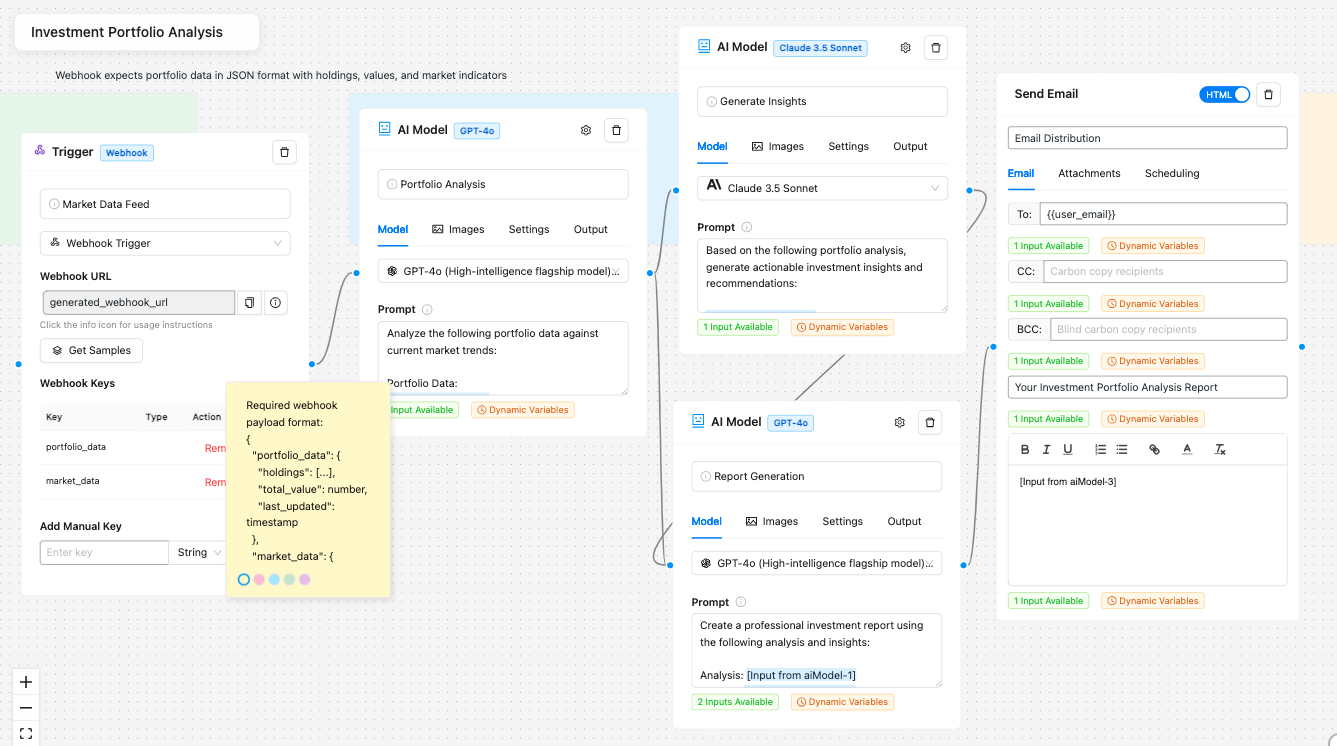

Investment Portfolio Analysis

Staying on top of investment performance is crucial. Agentic AI can analyze market data in real-time and provide actionable insights on investment portfolios.

Financial Risk Assessment

Managing financial risk is critical for banks. Agentic AI continuously monitors risk indicators and sends alerts when necessary. This helps in making swift decisions to mitigate risks.

Quarterly Financial Statements

Preparing quarterly financial statements is no small task. Agentic AI can generate draft statements, which are then reviewed and finalized by human experts. Companies like Savant are using such technology to streamline their financial reporting process.

The Impact of Agentic AI on Financial Institutions

Agentic AI is not just a tool; it’s a game-changer. Financial institutions that adopt this technology can see significant improvements in several key areas:

Improved Data Analysis

Agentic AI can analyze vast amounts of financial data, extracting meaningful insights. This enables predictive analytics and anomaly detection, helping financial institutions make better decisions. According to research, this capability improves data quality management by automatically identifying and correcting errors.

Automated Financial Planning and Analysis (FP&A)

Agentic AI transforms FP&A by adding predictive intelligence. It can deliver dynamic insights and forward-looking projections, making financial planning more accurate and efficient.

Streamlined Auditing

Traditional auditing can be time-consuming and prone to errors. Agentic AI enables continuous, real-time auditing, automating data collection and analysis. This enhances the accuracy of financial statements and saves a lot of time.

Case Studies: Agentic AI in Action

Let’s look at some real-world examples of how Agentic AI is making a difference in financial institutions.

Savant: A Leader in Financial Reporting Automation

Savant is a platform that helps businesses manage financial reporting and gain deeper insights. By using Agentic AI, Savant enables more data-driven decision-making, improving overall financial performance. According to Savant Labs, their technology is trusted by many financial institutions.

AI in Fintech Adoption

Around 72% of companies in the fintech sector are using AI in at least one business function. This adoption is improving data processing, security management, cost reduction, and customer service. According to Neontri, 67% of these organizations plan to increase spending on AI and data technologies.

Cost Savings Through AI

The implementation of AI in identity verification alone is expected to save banks $900 million in operational costs. It also reduces the time spent on digital onboarding processes by 29 million hours. According to Neontri, these savings highlight the financial benefits of using Agentic AI.

The Future of Agentic AI in Financial Reporting

The integration of Agentic AI into automated financial reporting is still in its early stages, but the benefits are clear. As technology continues to evolve, financial institutions that embrace Agentic AI will stay ahead of the curve, ensuring they meet evolving risk and regulatory requirements.

In conclusion, Agentic AI is transforming the way financial institutions handle their reporting tasks. By automating complex workflows and providing actionable insights, Agentic AI is not just a tool but a strategic asset. It’s essential for financial institutions to consider adopting this technology to enhance efficiency, accuracy, and compliance in their financial reporting processes.